CIO Viewpoint: Shifting Demographics - Is the World Getting Older?

The world needed roughly 11,800 years to reach its first billion in population, and just 11 years, from 2011 to 2022, to add its latest billion, where demographers expect the global population to reach 8 billion this year. Two metrics determine the change in the world population, namely the number of births and the number of deaths. Today, the rate of change at which this enormous number is growing is decreasing. Global population growth peaked in the 1970s at an annual rate of 2% and began its fall thereafter, dipping below 1% in 2021 to 0.9% today, reaching its lowest level since the 1940s. This is due to lower birth levels and longer life expectancies.

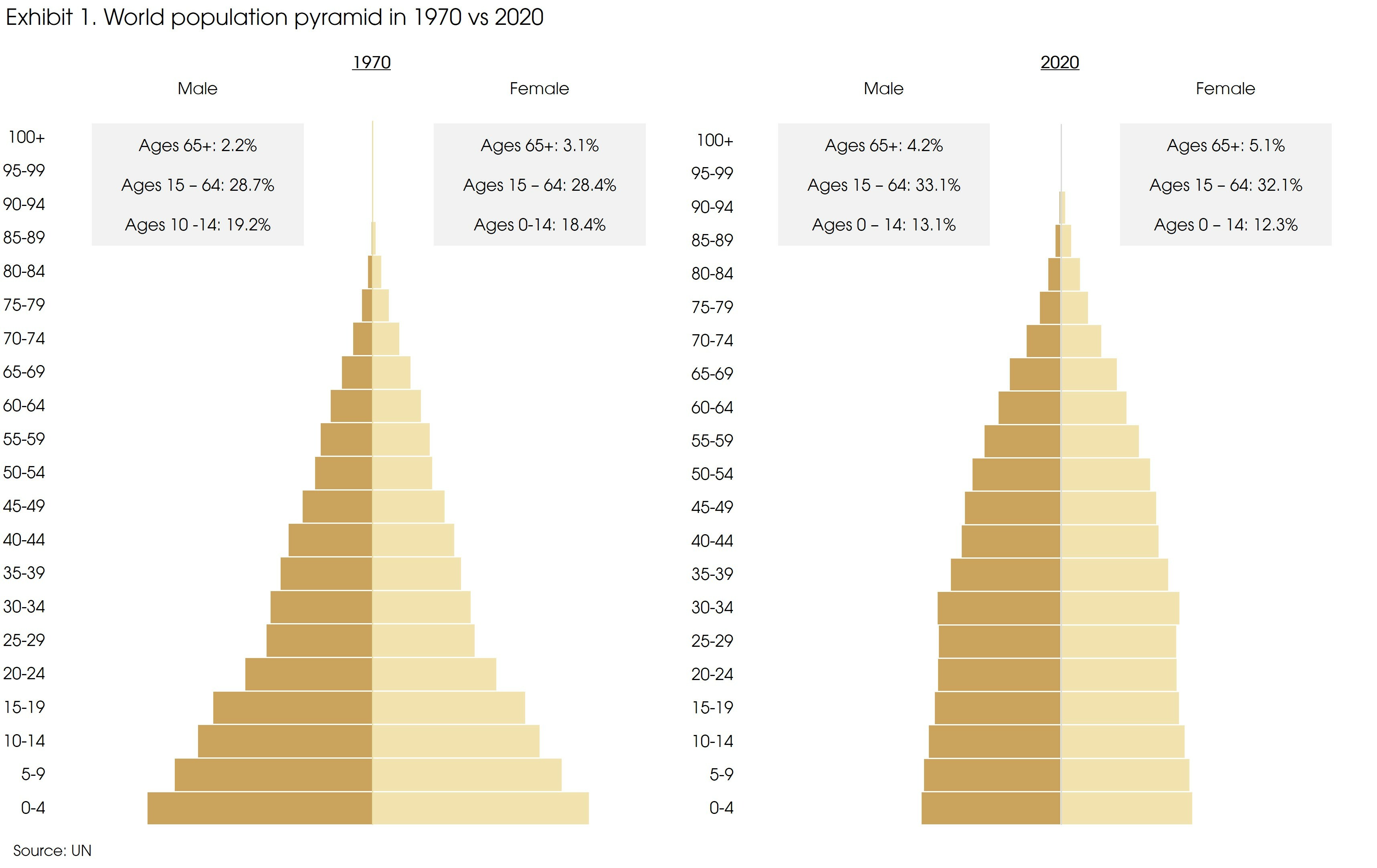

The population expansion was also accompanied by significant changes to its composition. The population pyramid that one may be familiar with is slowly transforming into a box shape and is expected to continue. Globally, age distribution is increasingly narrowing at the bottom and widening at the top (Exhibit 1). Different factors contributed to this change, such as increased education access encouraging women to delay their marriage and modern medicine improving life expectancies.

These factors led to a decline in global fertility and mortality rates. The culmination of these trends will impact different areas ranging from consumption patterns to labor productivity, which will be further explored in this viewpoint.

Peak Fertility

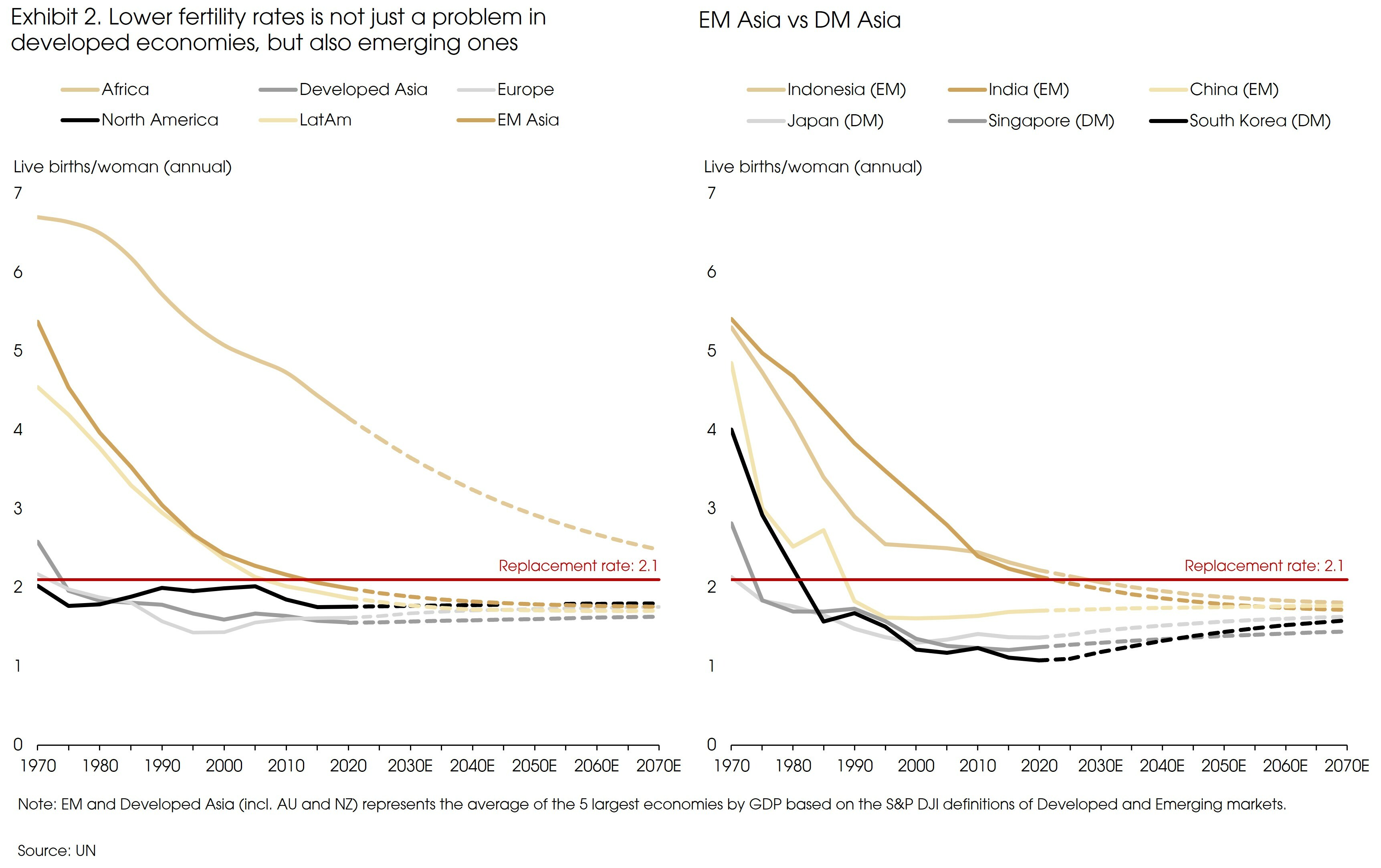

Fertility rates affect the bottom half of the pyramid and the future new entrants of an economy’s labor force. To put into context how drastically global fertility rates have been falling, live births per woman halved from 5 children in the 1960s to currently around 2.4. They are expected to further decline to 2.2 in 2050 according to the UN, marginally above the required replacement rate of 2.1 to maintain current population levels. This decrease is driven by multiple economic and social reasons, and the issue is not exclusive to developed market (DM) countries – it has alarmingly spread to major emerging market (EM) nations as well. Peaking fertility rates have several repercussions to the economy, including a smaller labor force and subsequently an aging population. A shrinking pool of labor supply may be inflationary due to a potential labor shortage and may put downward pressure on economic growth with less productivity and output.

Fertility Attitudes and Economics

The two primary drivers of the decline in fertility rates are social and economic, which are heavily interlinked. Social reasons include higher levels of education which empower women, better allowing them to establish their careers before marriage. This also ties into the economic element, where families worldwide face rising costs of raising children. According to OECD, families in western economies like the UK and US spend more than a quarter of their income on childcare, consuming 34% and 26% of their net income respectively. Going forward, as costs of supporting a child continues to increase (e.g., education and tuition, housing), people will be disincentivized to have more children as they face a dual burden – supporting both their parents as they exit the workforce and their children.

Demographic Contagion (DM vs EM)

As previously mentioned, emerging economies are also experiencing rapidly declining fertility rates (Exhibit 2). Most of the world’s regions have entered below replacement levels, with Africa being the only exception. This trend has negatively affected the working age population – as fertility decreases, a smaller pool of labor supply is available as there will be fewer new entrants to the workforce which may lead to a skills and labor shortage.

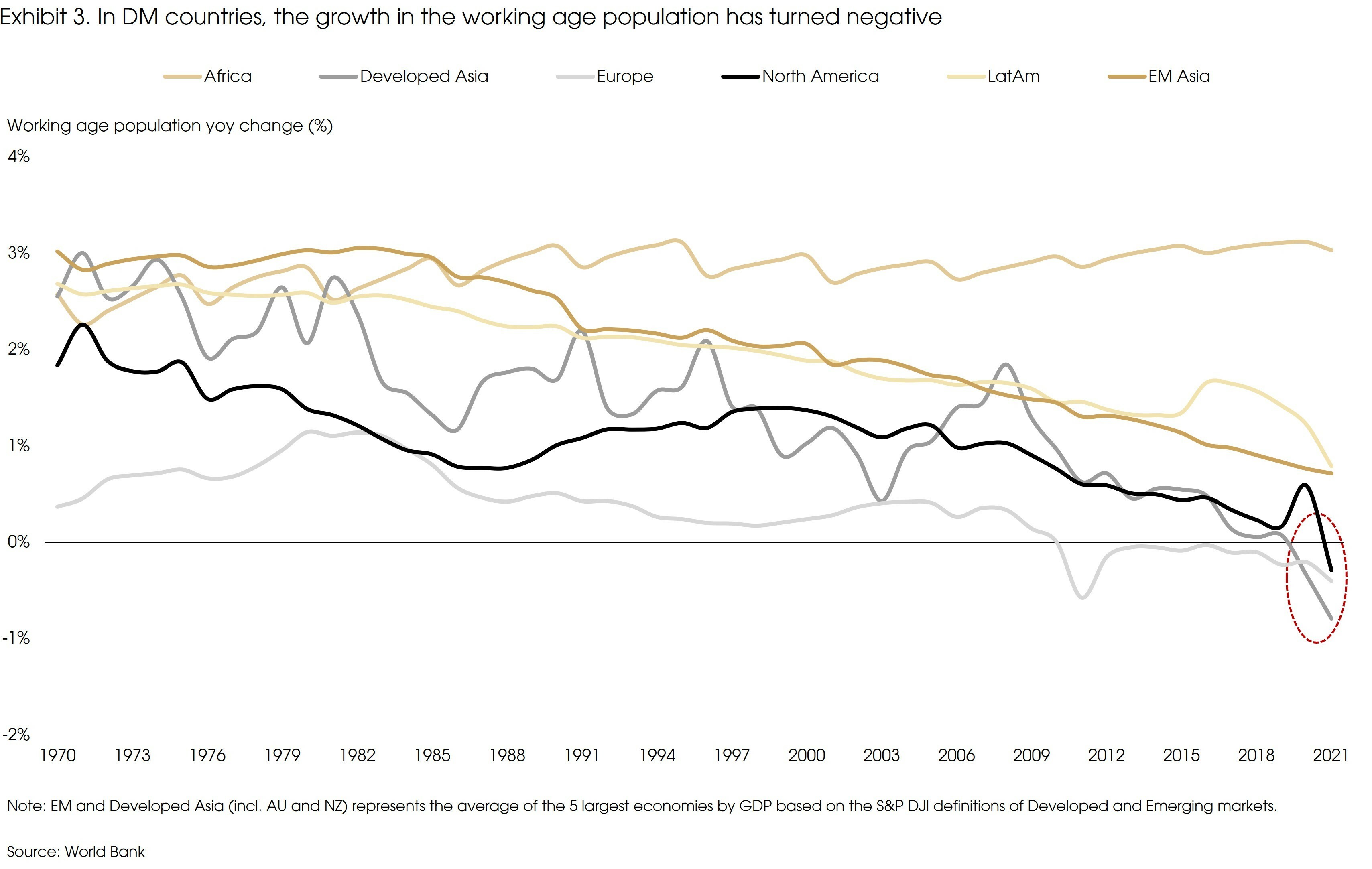

In DMs, the growth in the working age population has turned negative, while it is still positive in EMs and relatively high for Africa (Exhibit 3). The growth in this statistic is often utilized as an indicator for the long-term growth potential for a country, and it may be detrimental for DM countries if they are unable to reverse this trend. Korn Ferry forecasts a global talent deficit of more than 85 million people by 2030 and estimates that the financial impact could lead to US$8.45 trillion in unrealized annual revenues and productivity loss globally by 2030, if countries do not respond.

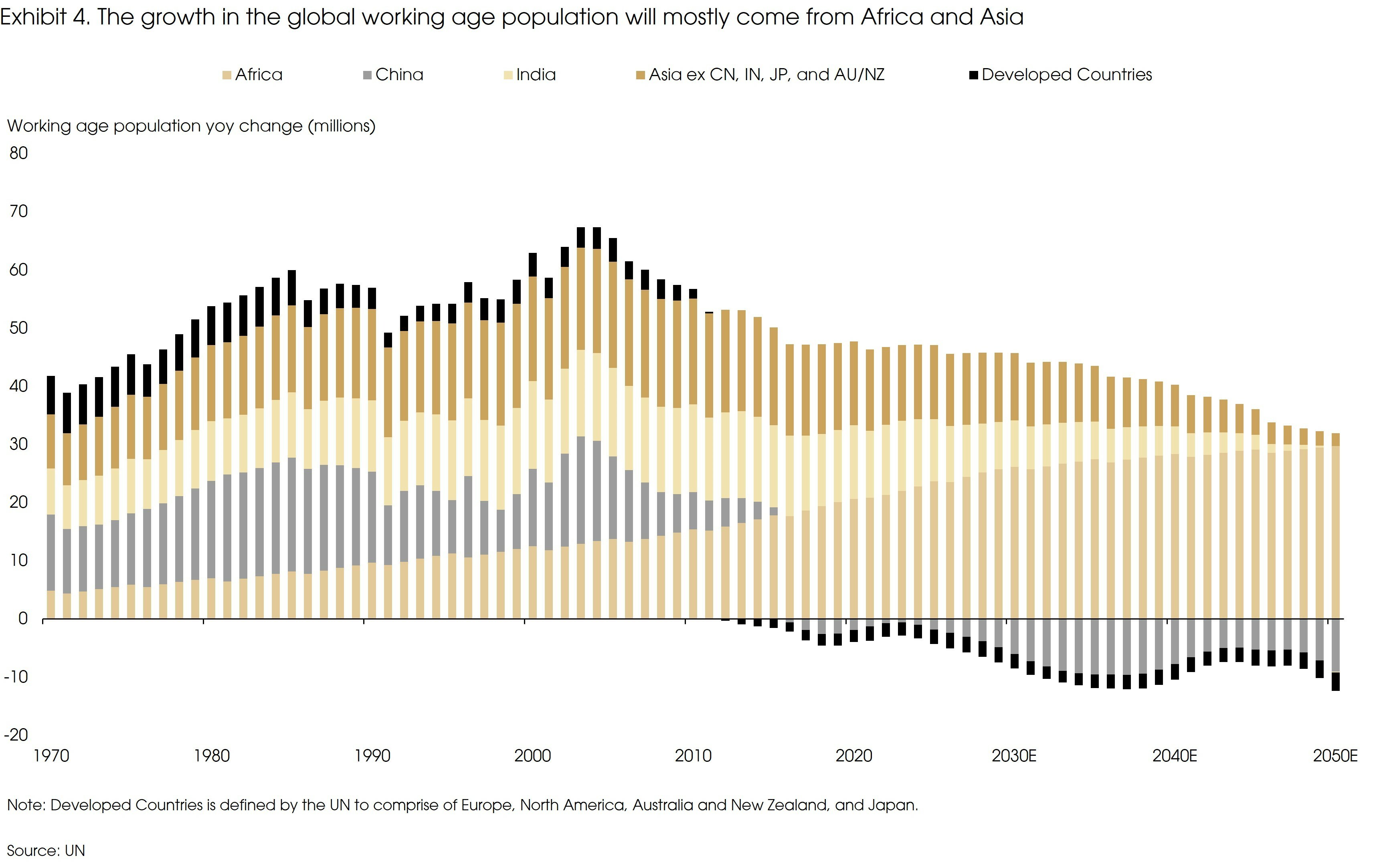

However, in EM Asian countries, there is a gap between some areas like China versus the younger Indonesia, India, and the Philippines. These economies are expected to grow in the next few decades driven by their younger population, and the UN projects India will add an additional 180 million working-age people by 2050 (Exhibit 4). However, for the region to capitalize on this positive, they would need to continue investing in integral areas such as education, healthcare, and infrastructure.

How to Invest – Peak Fertility

The healthcare and life sciences sector stand to benefit greatly from this trend. As more women decide to delay marriage, their fertility declines as they age. This would create demand for more disruptive technologies such as In Vitro Fertilization or other assisted reproductive businesses to boost fertility. Diagnosis tools and big data can also help in further increasing the success rate of newer treatments. Additionally, more companies are improving the attractiveness of their benefits packages as a way to retain talent, which includes incorporating fertility benefits. This area is a big opportunity for healthcare and fertility service providers as many are still under covered, with only 55% of companies with over 500 employees providing coverage according to Mercer.

However, despite the tailwind, governments need to also initiate policies that encourage childbirth to tackle this issue as people remain reluctant to have children, citing concerns such as rising costs of childcare. Tax incentives and education subsidies are potential supplements to ensure the effectiveness of policies like China’s recent three-child policy and successfully change people’s attitudes towards childbearing.

An Aging Population

In line with our investment megatrends, on the other end of the demographic spectrum, the world is getting older. The number of people aged 65 and over will more than double between 2019 and 2050 while those under 25 will peak and decline thereafter. Life expectancies will also increase from 72.3 years in 2020 to 76.8 in 2050 and 81.7 by 2100. Not only will this group expand as more people age into their late 60s, but they will also extend their lifetimes, signifying a long-term trend here to stay throughout the 21st century.

In this section, we will discuss the key areas affected by this trend and its implications.

Savings & Spending

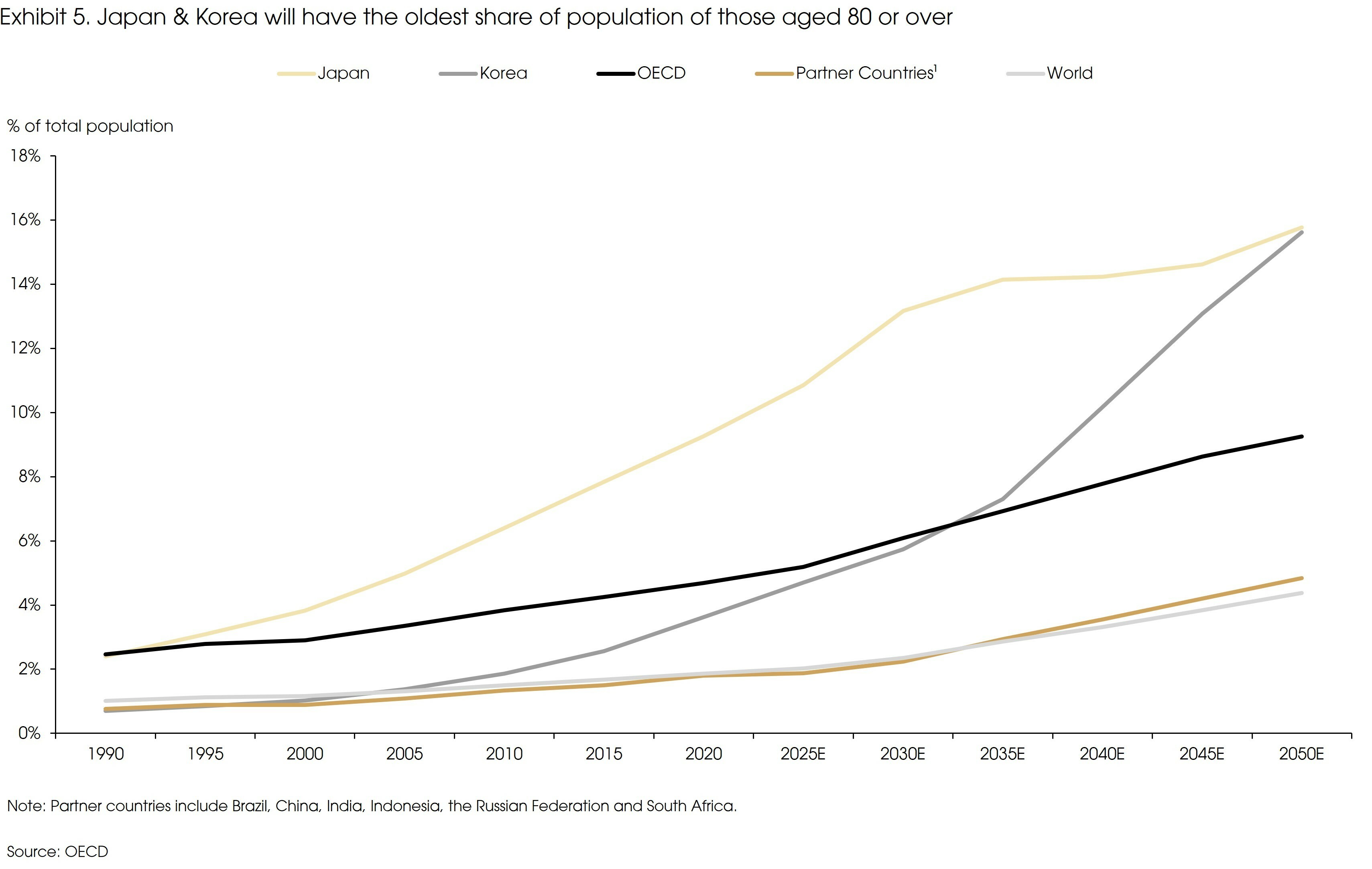

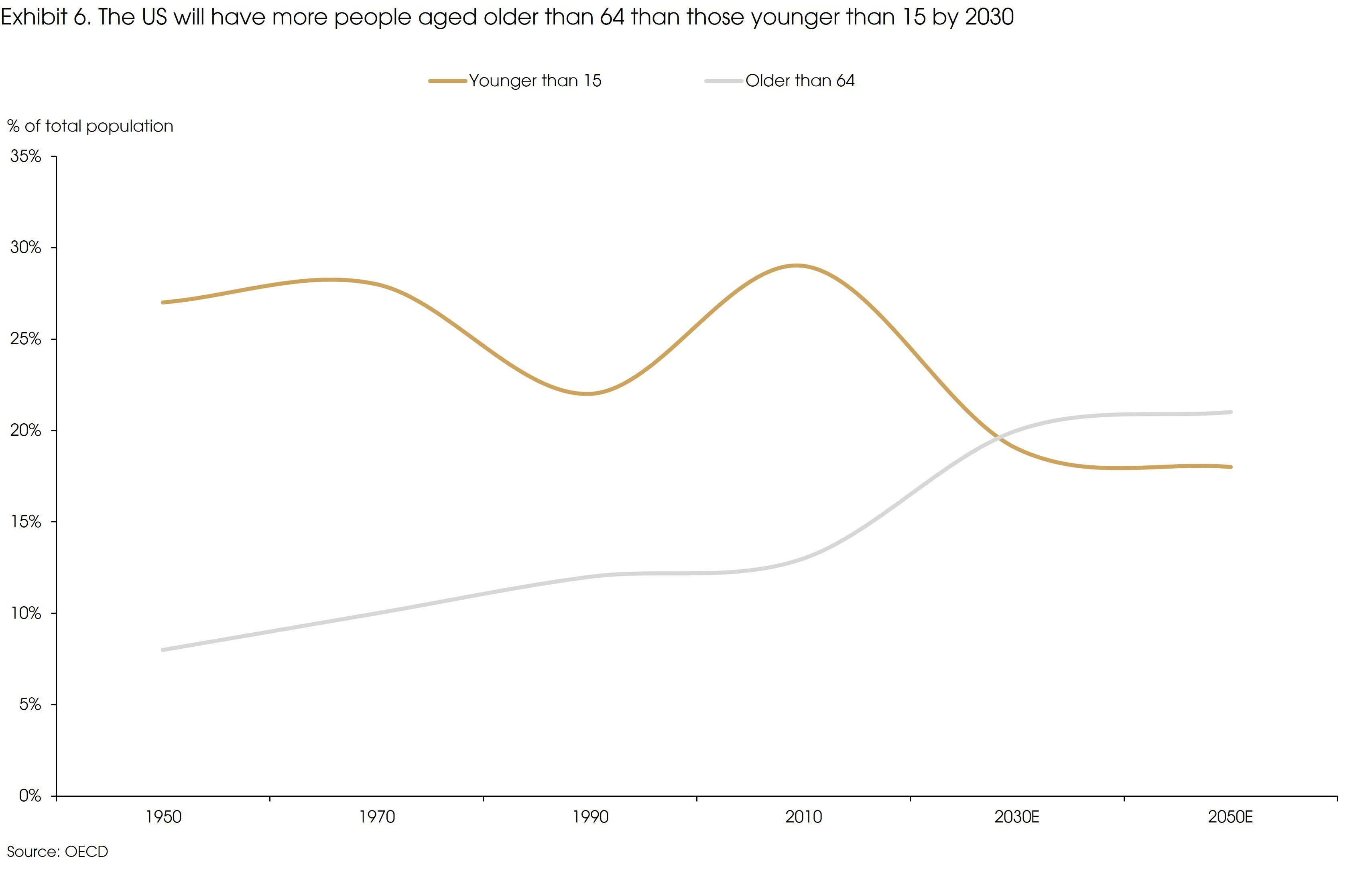

There will be a demographic shift between the younger and older generations, especially in the oldest age group of 80 and over that will see a tripling to a size of 426 million from 2020 to 2050 (Exhibit 5). The US will also see their 65 or older age group surpass the size of their 15 or younger demographic as soon as 2030 (Exhibit 6).

The older age group has a different consumption profile to the younger generation. Those entering the workforce are net savers as they tend to prioritize future consumption over the present. However, as people age, the more demands they will have, whether it’s a discretionary spending or having to support a family, and then once they enter retirement, they become net spenders. Their “future consumption” becomes present demands and as they are no longer generating income, they are not saving as much. Attitudes may also change towards spending to “enjoy life” after years of labor and savings.

In DMs that tend to have better pension plans and public policy, life after retirement is also more comfortable with more choices of goods and services to enjoy, whereas in EMs, pension schemes may be less generous, indicating lower spending ability. This structural divide between both DMs and EMs may influence a more significant impact on consumption for the former than the latter. A consequence to this is greater pressure on public budgets in the form of pension provision and investments for long-term care. In the EU, the dependency ratio is projected to increase from 34.4% in 2019 to 59.2% by 2070, which indicates the working-age population will have to support a greater number of dependents in the form of taxes and social security contributions.

Today, we are in the midst of an inflation crisis reaching levels we have not experienced since the 1970s and a rising interest rate environment. This is a stark contrast to the past decade of low single digit inflation and interest rates. One view foresees the current inflationary trend to stay into the next decade with much higher and more volatile numbers, supported by an aging population as more net spenders comprise the population than net savers. The deglobalization risk discussed in our previous viewpoint also adds another aspect as the talent market shrinks not just in domestic size but in geographic reach, increasing wages. Attitudes may also be more willing to accept higher costs for stability and reliability.

Longevity

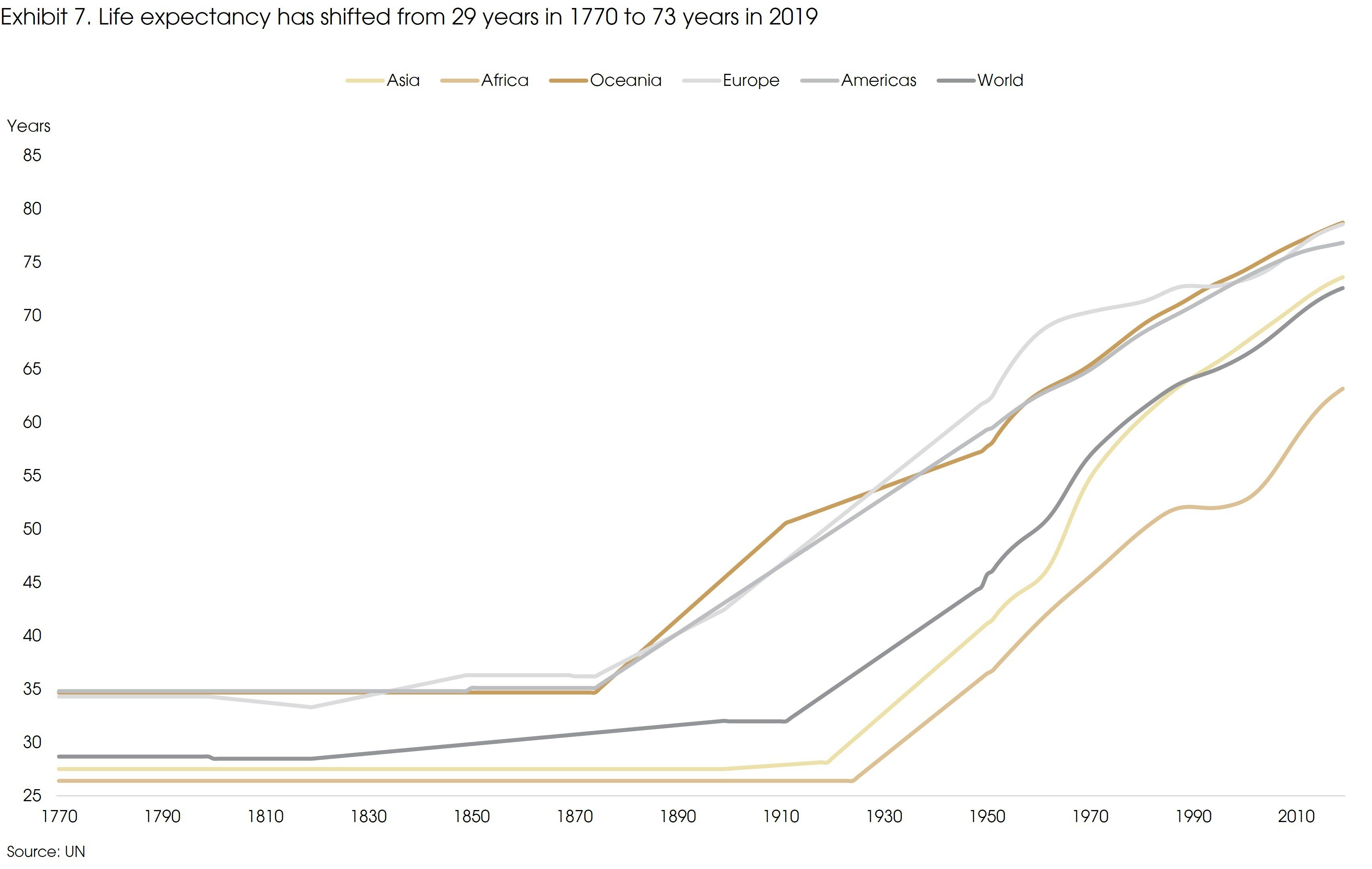

The grey population is not only expanding, but also extending. According to the UN, every five years, life expectancy increases by roughly one year. This is attributed to lifestyle improvements, modern medicine, and lower child mortality in most parts of the world. However, these numbers are more pronounced in DMs, such as those in Japan are expected to live past 80, versus those in Sub-Saharan Africa who are expected not to live beyond 60 (Exhibit 7). This is no surprise given the greater advancements in technology and medicine and availability of more nutritious meals with more financially able citizens in DMs.

On one side, an expanding grey population means those leaving the labor force are increasing and will continue to pressure public pension budgets. However, one counterargument could be the increasing longevity may lead to a higher need to save for future consumption. Hence, more people may decide to stay in the workforce longer or return to increase their savings for the future. Others may also invest in their human capital via health and education earlier and longer, increasing their labor productivity. These effects may mitigate the negative impacts of a potential shrinking working-age population.

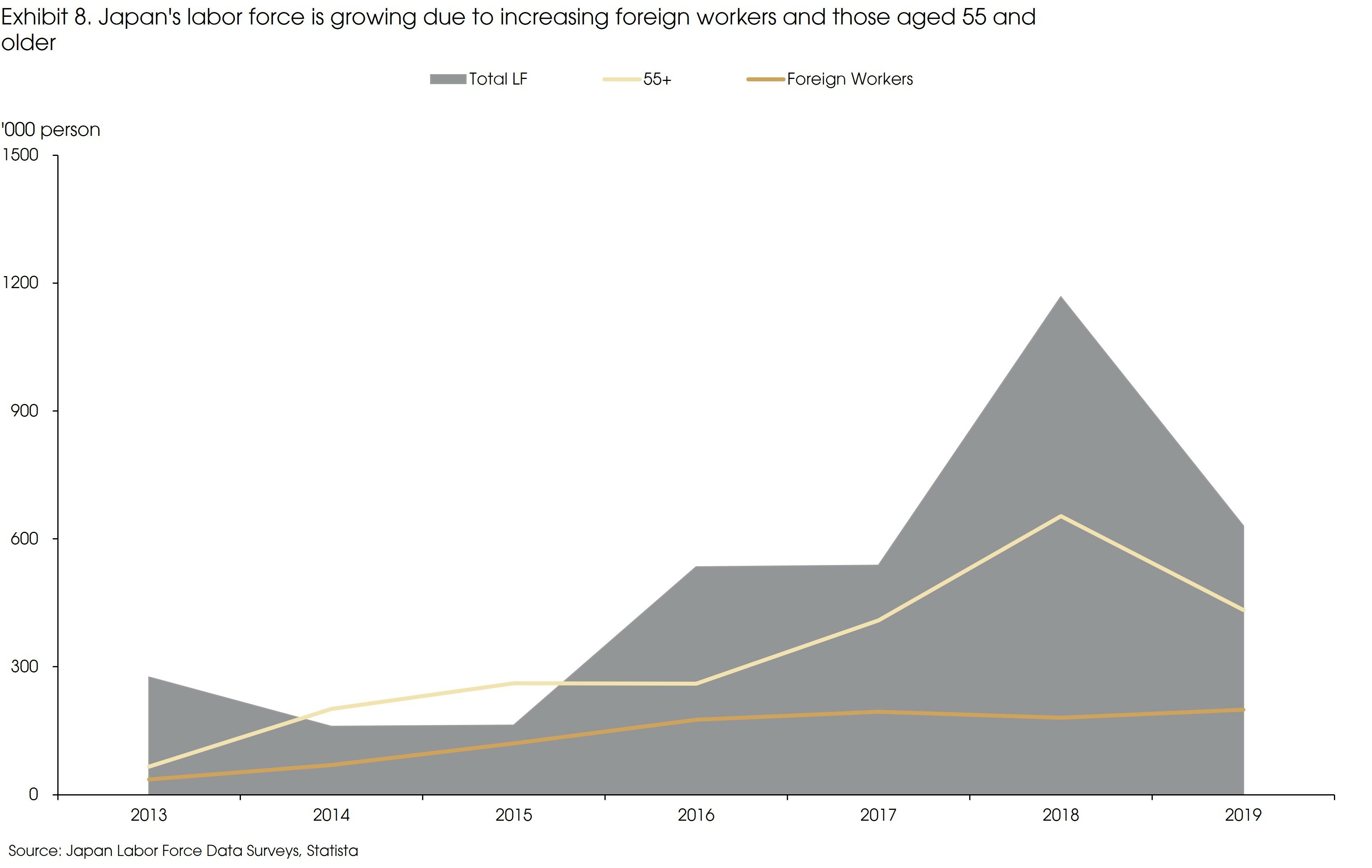

Japan has been experiencing this aging population for over a decade and have remained in a disinflationary environment. On one side, it is their loosening immigration policy contributing to this as their labor force expands, putting downward wage pressure, but the higher life expectancy also adds to extending their labor force participation by later retirements and more returning workers (Exhibit 8).

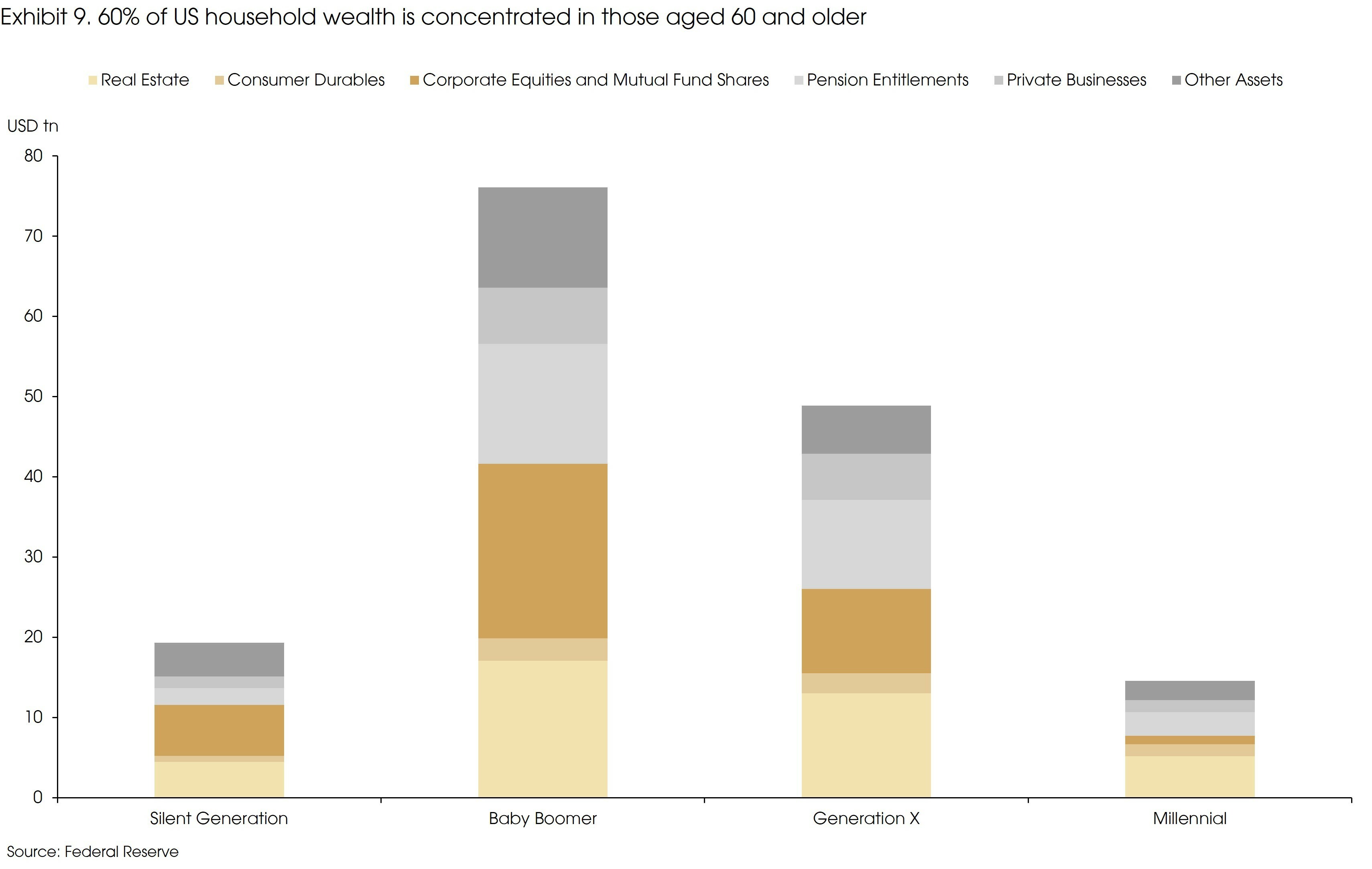

The Silver Economy

The older one gets, the greater the amount of wealth they would have amassed. In the US, 60% of household wealth is concentrated amongst those aged 60 or over, hence, with an expanding aging demographic, there will be a greater demand for better financial planning (Exhibit 9). Both Silent and Baby Boomer generations have also started to arrange for transfers of their wealth to the younger generation, especially Millennials. This is estimated between US$35 to 68 trillion, which is expected to make Millennials 5x wealthier as soon as 2030. This windfall of wealth through inheritances and trusts will further add to the need for financial planning for wealth preservation and growth.

This creates an opportunity for the financials sector with wealth managers and insurers as standouts. On one side, wealth managers will have to be prepared and polished to provide the best-in-class services, tailor-made to address the silver economy’s bespoke needs and adapt to cultural changes and new technologies (e.g., cryptocurrency). On the other hand, more people will have increasing awareness of longer lifespans, and therefore demand retirement-focused financial products.

How to Invest – Aging Population

A growing grey population will put more demand on medical devices (e.g., blood pressure monitors), infrastructure (e.g., wheelchair-friendly designs) and managed care services (e.g., homes for the aged, at-home nurses). More investment towards disruptive technologies for the life sciences would also be of greater demand to treat diseases and increase longevity.

This aged demographic will also require better wealth management services to efficiently preserve and transfer their wealth onto the next generation. DMs like Europe and Japan are going to be especially affected by this with both wealthier and older citizens. An opportunity for more integrated effective and preventive health management packages, sophisticated pension plans including private schemes, investment services, and financial lifecycle planning should benefit from this trend.

Sources: Bank of America, Federal Reserve, Japan Labor Force Data Surveys, Korn Ferry, Mercer, Statista, UN, World Bank, World Economic Forum, and CIGP Estimates