Focus: China Conversion from Coal to Natural Gas

David Ho

Millions of people in China are suffering the effects of serious air pollution and continue to breathe hazardous chemicals every day. Coal-burning for power plants, heavy industry, and winter heating are largely responsible for China’s high levels of air pollution. However, the Chinese government has been taking serious measures to curb carbon emissions in recent years. As coal accounts for more than 60% of the nation’s energy consumption, the Chinese government has been actively looking for cleaner alternative energy sources; this includes natural gas.

Natural gas is an attractive alternative fuel for China because it emits less pollutants per million than coal, comes with abundant supply reserves as compared to peer renewables, and natural gas could act as a more reliable base load energy source than coal.

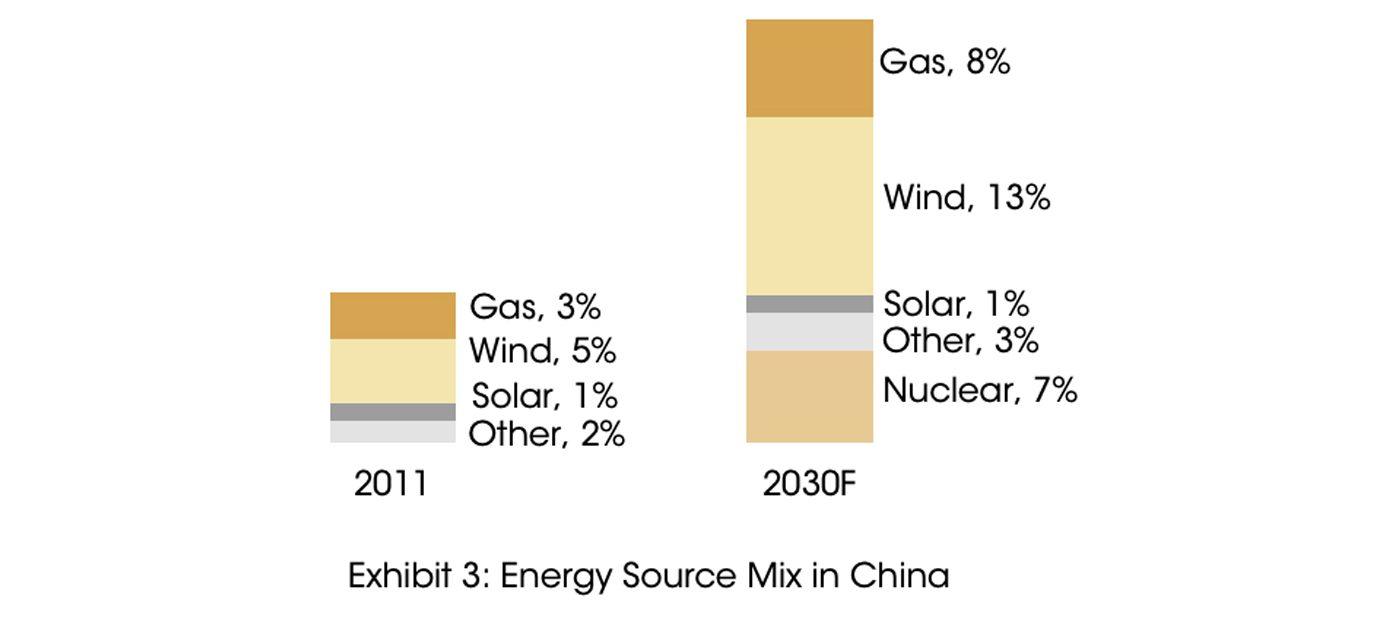

The demand for natural gas in China has enjoyed strong growth over the past several years on the back of strong and improving policy support. Natural gas consumption was a robust ~16% from 2005 to 2016. However, the portion of natural gas in China’s energy mix is still in the single digits. [See below the Exhibit 3] This lags behind peers’ which average 23.7%.

China is targeting to increase the energy consumption proportion of natural gas from 5.9% in 2015 to ~10% in 2020, and ~15% in 2030. China’s objective to ”make the skies blue again”, through its 13th Five-Year Energy Development Plan which has introduced a mandatory target to promote “coal-to-gas” conversions as the primary measure to fight pollution.

Simultaneously, local governments are starting to shut down smaller coal-fired boilers due to stricter environmental standards in order to meet upcoming carbon emissions targets. This makes industrial coal-fired boiler conversions one of the major long-term growth drivers for natural gas consumption.

Also, winter heating using coal in rural households, particularly in the northern regions is believed to be another major contributor to China’s air pollution. The government has introduced subsidy schemes to encourage gas usage and modify installation costs. The market remains foreseeably large for rural “coal to gas” as China’s urbanization phenomenon continues to grow.

The government has also implemented policies to strengthen the supplies of natural gas and therefore lower gas prices to stimulate demand. Due to its limited domestic gas supply, China has been increasing its LNG (Liquefied Natural Gas) imports, and is concurrently building pipelines for gas imports from Central Asian countries and Russia (a key facet for one of our best ideas in portfolios). The future establishment of a national pipeline company also aims to lower end-user gas price by lowering the transportation cost of the middle stream players.

In summary, we believe that there are plenty of factors to support continuous growth in China’s natural gas consumption in the coming 5 to 10 years. We believe that a number of selected downstream gas distributors will represent the best investment opportunity in China’s clean energy space, due to their volume driven recurring cash generative gas-sales model and high growth from both city and rural coal to gas connection conversions.